In the press release, Max Bardon, vice president of Amazon Worldwide Payments is quoted as saying, “We’re excited to continue to offer customers even more options when it comes to how and when they want to pay for their order.”

At the beginning of holiday shopping season, Amazon is probably even more excited about the potentially billions of dollars in both revenue and savings this deal represents.

First, an Interchange Primer

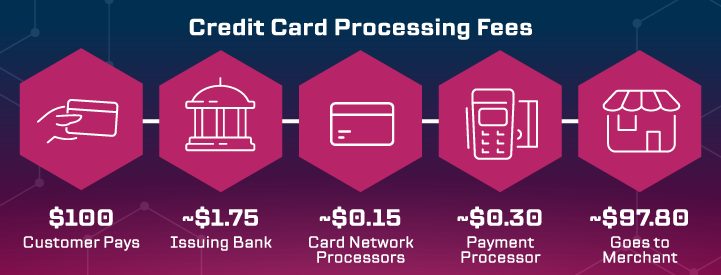

When you use a credit card, interchange is money paid by the merchant that flows to the bank issuing the card. It averages just under 2% for credit cards and higher for rewards cards.

On top of that, the merchant pays additional fees for processing the transaction, with some money (“assessments”) going to the card networks (e.g., Visa, Mastercard) and some going to the company that processes the transactions, but the bulk of what the merchant pays is interchange. Collectively, these are known as the total credit card processing fees, or more colloquially as a swipe fee.

Side note: with American Express, the merchant pays one fee called the discount rate that comprises all three elements. This is because American Express acts as issuer, processor, and network combined.

Now, interchange is higher in the US than in almost any other country, and merchants… well, they kinda hate it: both the cost and the fact they generally cannot negotiate the fee. They have been fighting interchange for years, and in 2010 they won a battle when interchange on debit cards was capped for cards issued by large banks via the Durbin Amendment.

But interchange on credit cards remains untouched; and in fact, it increased in 2022.

Merchants who wish to avoid interchange fees can choose to just not accept cards, but that’s not an option for most these days, at least in the B2C world.

Another path is to convince consumers to use a cheaper electronic method to pay. This has been tried in the past. Merchants tested a method a few years ago called Merchant Customer Exchange that required customers to adopt a new payment. But it failed spectacularly.

Another Attempt Around Interchange

The recent announcement that Amazon will begin accepting Venmo for payment marks a turning point, and even a win for Amazon, for PayPal (Venmo’s owner), and for merchants… along with a watch-out for card-issuing banks and networks. Why?

Four reasons:

- Greater merchant acceptance of Venmo. As a P2P payment method, Venmo had long been a money-losing venture: if you used your bank account to fund your wallet, you paid nothing, and the recipient paid nothing. When Venmo is used to pay merchants, however, the merchant paid a fee. So PayPal (Venmo’s owner) has been trying to get more merchants to accept Venmo. The Amazon deal is therefore a very big win for them.

- More payment options. Amazon wants every customer to be able to easily complete a purchase, so providing more payment options helps with that. This generates more sales and perhaps more importantly avoids point-of-purchase abandonment.

- Cost avoidance. I think the cost avoidance opportunity is huge. Amazon operates on thin margins, so every basis point less they pay to accept a payment means a commensurate increase in margin. Venmo’s posted rate for merchants would save Amazon something, and I’m sure Amazon is getting a significantly better rate than that.

- Embracing newer payment trends. Younger generations are more accustomed to paying for things with Venmo, so Amazon is correctly recognizing, embracing, and promoting this payment method. As a byproduct, consumers from other generations will see this and perhaps grow more accustomed to paying for things with Venmo. This by extension opens the door to digital wallets, which could generate more acceptance at physical merchants, especially if other digital wallets like Square Cash are in the mix.

But some banks are already heeding these watch-outs.

There was a recent article in the Financial Times titled “How JPMorgan’s plan to kill credit cards split the bank: Jamie Dimon warned executives to put aside rivalries and deliver critical ‘pay-by-bank’ project”. Dimon sees greater importance on non-card payments in the future and doesn’t want to be left behind.

Visa and Mastercard see this too, as evidenced by their recent acquisitions of open-banking platforms Tink and Finicity, respectively. [Editor’s note: expect a lot more discussion on Open Banking in this space!]

The Bottom Line

So what does this all mean?

- Consumers will have more payment options available to them at checkout.

- Consumers – especially younger generations – are growing more comfortable paying directly from their bank accounts and are more likely to adopt payment products based on this method. (Open banking will accelerate this.)

- Consumers will pay more attention to the value proposition of card payments when making a payment decision at the time of purchase.

Does this mean the end of interchange? Far from it.

Payments volume will continue to grow, and as the pie gets bigger, the bulk of it will remain with today’s card issuers. But that slice of the pie outside of interchange will only get bigger, and payments providers are taking notice.

FinTechs are also playing a bigger role in disrupting the interchange model (e.g., Marqeta), not by driving down interchange fees, but changing who benefits from them. But that’s for another article!

Just remember: the customer remains in charge. So offering a product that meet their needs will continue to be the best path to success.

Further Advisory helps major financial institutions unleash value from their fintech relationships. From partnership strategy and due diligence to implementation and go-to-market, we make the business case become a reality.